We often take the intricate global dance behind our favorite gadgets for granted. But shifts in international trade policy can have very direct consequences for the devices in our pockets. A recent Wall Street Journal piece dives into a topic that could hit close to home for many tech consumers: the potential impact of renewed US tariffs on Chinese goods, specifically focusing on Apple’s iconic iPhone.

Summary of the Situation

The core issue explored in the WSJ article (linked below) revolves around the possibility of significant tariffs being imposed on goods imported from China, potentially under a future administration revisiting policies from the Trump era. Given the iPhone’s deep manufacturing roots in China, it stands as a prime example of a product that could be directly affected.

Key takeaways from the reporting include:

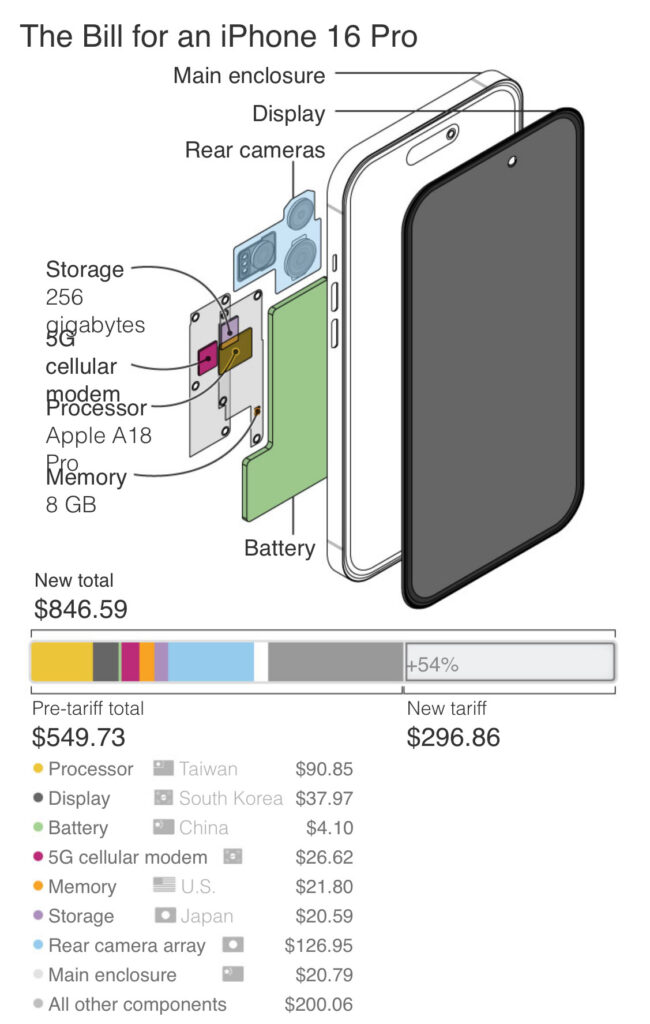

- Significant Price Increase: Analysts estimate that substantial tariffs (potentially mirroring past proposals) could force Apple to raise iPhone prices considerably, with some projections suggesting an increase of over $100 per device to offset the new costs.

- Apple’s Diversification Efforts: Apple has been actively working to diversify its manufacturing footprint, notably increasing production in countries like India and Vietnam. While significant, this shift hasn’t fully decoupled its reliance on China’s highly developed electronics supply chain.

- Complex Supply Chain: Moving intricate manufacturing processes like those for the iPhone is a slow, complex, and expensive endeavor. Even with diversification, a large portion of assembly and component sourcing remains tied to China, making it difficult to completely sidestep tariff impacts in the short-to-medium term.

- Consumer Impact & Strategy: Such a price hike could significantly impact consumer demand. Apple would face a tough decision: absorb the tariff costs (hitting their margins), pass them partially or fully to consumers (risking lower sales), or find some complex combination thereof.

Essentially, the article paints a picture where geopolitical trade decisions could directly translate into higher costs for one of the world’s most popular consumer products, despite Apple’s ongoing efforts to build resilience in its supply chain.

A Critical Perspective

While the WSJ article clearly outlines the potential direct cost implications, it’s worth considering a few broader points:

- The Precision of Estimates: Predicting the exact price increase is inherently difficult. The final impact depends on the specific tariff percentage, potential exemptions, Apple’s strategic pricing decisions, currency fluctuations, and the overall state of the global economy at the time. The $100+ figure is a stark estimate, but the reality could be more fluid.

- Beyond Price – The Ripple Effects: The focus is often on the consumer price tag, but tariffs create wider ripples. They can strain international relations, potentially invite retaliatory tariffs impacting other sectors, and create long-term uncertainty for companies making global investment decisions. Is the intended goal of the tariff (e.g., boosting domestic production, addressing trade imbalances) effectively achieved, or do the disruptions outweigh the benefits?

- The Diversification Reality: While Apple’s move towards India and Vietnam is strategically sound for long-term risk mitigation, the article implicitly highlights the sheer scale and sophistication of China’s manufacturing ecosystem. Building parallel capabilities elsewhere takes immense time and investment. Tariffs might accelerate this shift, but they could also disrupt the existing, highly efficient (if geographically concentrated) system before alternatives are fully mature, potentially leading to unforeseen bottlenecks or quality control challenges.

- Who Ultimately Pays?: While the narrative is often “company vs. tariff,” history suggests that tariffs imposed on imports are frequently passed through, in large part, to consumers or downstream businesses. The debate then becomes less about punishing a country or company and more about the impact on domestic consumers and inflation.

The prospect of more expensive iPhones due to trade policy serves as a tangible reminder of how interconnected global economics, politics, and the technology we use every day truly are. It underscores the delicate balance companies navigate and the potential costs consumers might bear when that balance is disrupted.

Source:

The Wall Street Journal – iPhone Prices Could Jump Over $100 Under Tariffs on China

https://www.wsj.com/tech/personal-tech/iphone-apple-tariffs-china-bb20c7a3?st=xaZQfQ